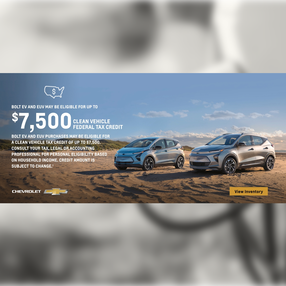

Exciting news for eco-conscious car shoppers! If you're considering the purchase of a Bolt EV or Bolt EUV, you could be eligible for a substantial Clean Vehicle Federal Tax Credit of up to $7,500. This federal incentive is designed to encourage the adoption of clean, electric vehicles and reduce our carbon footprint. However, eligibility is subject to specific criteria, so it's advisable to consult with a tax, legal, or accounting professional to assess your qualification. Let's delve into the details. Understanding the Clean Vehicle Federal Tax Credit: The Clean Vehicle Federal Tax Credit is a fantastic opportunity for you to save on your Bolt EV or Bolt EUV purchase. This credit can significantly lower the cost of these impressive electric vehicles, making them an even more attractive choice for environmentally conscious consumers. Click here to browse our inventory.

At Courtesy Chevrolet, we're dedicated to helping you make informed decisions about your vehicle purchases. To learn more about the Clean Vehicle Federal Tax Credit and how it applies to the Bolt EV and Bolt EUV, please visit the official website at https://www.fueleconomy.gov/feg/taxevb.shtml. Don't hesitate to reach out to our knowledgeable team with any questions or to explore our impressive lineup of electric and hybrid vehicles. Together, we can drive toward a cleaner, more sustainable future while enjoying potential savings along the way.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Welcome to the Courtesy Chevrolet blog – your place for Chevrolet news and reviews. Brought to you by Courtesy Chevrolet.

Website: CourtesyChev.com Phone: 602-798-2940 Click here to take a virtual walk-through of Courtesy Chevrolet.

LocationClick map to enlarge

Centrally located 1233 E. Camelback Road in Phoenix, Arizona, 85014 Click here for our hours Like Us On FacebookFollow Courtesy Chevrolet on TwitterArchives

May 2024

Categories

All

Produced by 72 Advertising

|

Courtesy Chevrolet - 1233 E. Camelback Rd. Phoenix, AZ 85014 - Phone: 1-888-267-5511

RSS Feed

RSS Feed